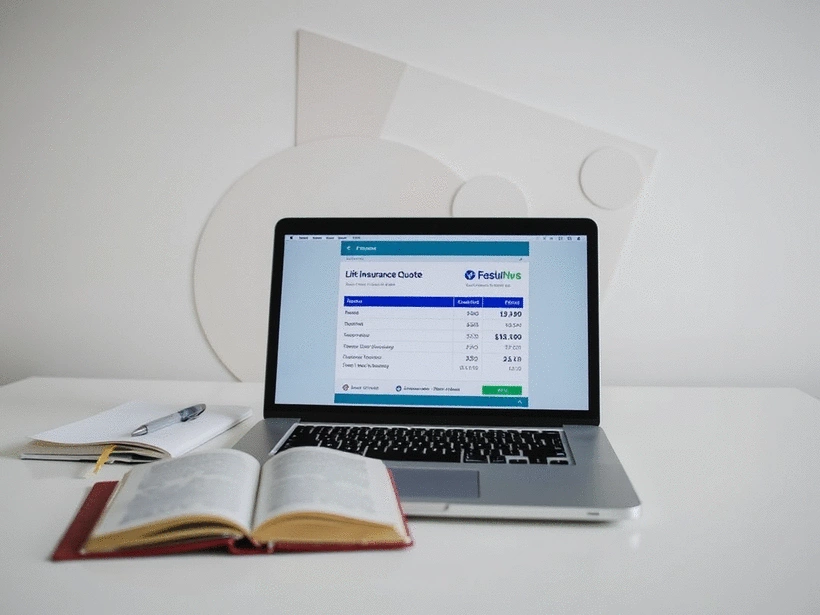

Instant Online Life Insurance Quotes

Did you know that obtaining life insurance quotes online can significantly streamline your decision-making process? With just a few clicks, you can access a wealth of information, enabling you to make informed choices for your family's financial future.

What You Will Learn

- Convenience of accessing life insurance quotes from home, eliminating the need for in-person meetings.

- Importance of protecting personal information while comparing quotes online.

- Differences between term, whole, and universal life insurance policies and their respective benefits.

- Key factors to consider when analyzing life insurance coverage options, including policy limits and additional features.

- Steps to prepare before requesting quotes to save time and enhance decision-making confidence.

- The significance of thorough comparison in selecting the best policy for your needs and goals.

Compare Life Insurance Online: Benefits & Policy Types

Discover the key advantages of online life insurance quotes and explore the main policy types you can compare with ease!

Benefits of Online Quotes

- ✓ Unmatched Convenience & Speed

- ✓ Protection of Personal Information

- ✓ Access Multiple Insurers

Key Takeaways for Quoting

- ✓ Gather Info & Choose Reliable Tool

- ✓ Input Accurately & Compare Thoroughly

- ✓ Make Decision & Connect with Agent

Life Insurance Types

- ● Term Life: Affordable & Time-limited

- ● Whole Life: Permanent & Cash Value

- ● Universal Life: Flexible Premiums

Coverage Analysis

- ● Death Benefit Amount

- ● Policy Duration & Renewal

- ● Riders & Additional Coverage

Understanding the Benefits of Instant Online Life Insurance Quotes

When it comes to securing your family's financial future, having access to instant online life insurance quotes can be a game changer! It allows you to make informed decisions quickly and conveniently. But why exactly should you choose online quotes over traditional methods? Let's explore the benefits together.

Why Choose Online Quotes Over Traditional Methods?

Convenience and Speed in Obtaining Quotes

One of the main advantages of obtaining life insurance quotes online is the unmatched convenience it offers. You can access quotes from the comfort of your home, at any time that suits you. No more waiting for agents to call or schedule in-person meetings!

Additionally, the speed of receiving quotes online is phenomenal. With just a few clicks, you can receive multiple quotes in minutes. This allows you to compare various options without the hassle of visiting multiple insurance offices. This convenience is a key reason why many consumers are turning to online platforms for their insurance needs, as highlighted by resources like NAIC Consumer Information. Sounds great, right?

- Get quotes at your own pace

- Eliminate waiting times

- Access a variety of insurers in one place

Protection of Personal Information and Privacy

In today's digital world, privacy is a top concern, and rightly so! Online platforms often have secure systems in place to protect your personal information. This means you can obtain quotes without worrying about your data being misused.

Moreover, many online services allow you to compare quotes without requiring extensive personal details upfront. This way, you can maintain a level of privacy while still exploring your life insurance options.

Types of Life Insurance You Can Compare Online

Exploring Term, Whole, and Universal Life Insurance Options

When you start comparing life insurance quotes online, you’ll come across various types of policies. The most common are term, whole, and universal life insurance. Each has its unique features and benefits. The ACLI Fact Book provides comprehensive data on the prevalence and characteristics of these different life insurance products in the market.

Term life insurance is a straightforward, temporary solution, while whole life insurance provides lifelong coverage along with a cash value component. Universal life insurance offers flexibility in premium payments and death benefits. Understanding these differences is crucial for making the best choice!

- Term Life: Affordable and time-limited coverage

- Whole Life: Permanent coverage with cash value

- Universal Life: Flexible premiums and benefits

Understanding No-Exam Life Insurance and Its Advantages

No-exam life insurance is gaining popularity for those who want to skip medical exams altogether! This type of policy can be obtained quickly, often with fewer questions about your health. It’s particularly beneficial for individuals who may have health concerns or busy schedules.

However, while this option is convenient, it’s essential to review terms carefully. You might find that the coverage limits are lower than traditional policies, so knowing your needs is vital.

Analyzing Coverage Options: What to Look For

When comparing life insurance quotes online, it’s important to analyze coverage options thoroughly. Look for key aspects such as the policy limits, premium rates, and any additional features. For those seeking cost-effective solutions, platforms like Insurify offer tools to help find affordable life insurance options tailored to individual needs.

Consider the following points during your analysis:

- Death benefit amount

- Policy duration and renewal options

- Riders or additional coverage options

By taking the time to assess these factors, you’ll be better equipped to choose the right policy that fits your family’s financial goals.

Pro Tip

When comparing life insurance quotes online, always consider the total cost over the life of the policy, not just the initial premium. Factoring in potential increases in rates, policy renewals, and any additional fees can provide a clearer picture of what you'll be paying in the long run.

Summarizing the Process of Getting Instant Online Life Insurance Quotes

Now that we've explored the detailed steps to obtain instant online life insurance quotes, let’s recap the key takeaways that will help you navigate the quoting process smoothly. Having a clear understanding of the steps involved can make your experience less daunting and more efficient!

Key Takeaways from the Step-by-Step Guide

When you're ready to get started, keep these essential steps in mind for a streamlined online quoting experience:

- Gather all necessary personal and financial information.

- Choose a reliable online quote tool that offers comprehensive comparisons.

- Input your information accurately to ensure you receive precise quotes.

- Compare the quotes you receive thoroughly to weigh your options.

- Make your final decision and be ready to connect with an agent if needed.

Being prepared before you initiate your quote request can save you valuable time and help you avoid common pitfalls. Having all information at hand not only speeds up the process but also enhances your confidence in making the right choice!

Benefits of Being Prepared Before Initiating Your Quote Request

Preparation can lead to better outcomes when seeking quotes. Here are some benefits of being ready:

- You’ll save time by providing complete information upfront.

- Better clarity on your coverage needs will guide your comparisons.

- Increased likelihood of receiving tailored quotes that meet your requirements.

By following these preparatory steps, you’ll find the quoting process to be not just efficient but also quite empowering. Remember, being informed is key to making decisions that support your financial future!

Encouragement to Compare and Choose Wisely

As you move forward, it’s crucial to take your time comparing the quotes you receive. This ensures that you choose the best policy for your needs without feeling rushed. At Life Insurance Internet, we emphasize the importance of thorough comparison because small differences can lead to significant impacts over time.

Understanding the Importance of Thorough Comparison and Cost Comparison

When it comes to life insurance, not all policies are created equal. Here’s what to consider:

- Premium rates: Ensure you understand how much you will pay over time.

- Coverage amounts: Compare how much each policy will provide to your beneficiaries.

- Policy types: Different policies offer varying benefits and features.

Taking the time to analyze each aspect carefully can help you find a policy that aligns with your financial goals and provides your loved ones with the protection they deserve.

Next Steps: How to Proceed After Receiving Your Quotes, Including FAQs on Coverage and Claims Process

After receiving your quotes, it’s essential to know your next steps. Here’s what you can do:

- Contact agents if you have questions; they can clarify coverage details.

- Review FAQs regarding the coverage and claims process to understand your options.

- Finalize your choice by considering policy customization and beneficiary designations.

Taking these steps will ensure that you’re not just choosing a policy, but making a comprehensive decision that secures your family’s future. Remember, you’re not alone in this journey! If you have questions, I’m here to help you navigate them. Let’s make this process as smooth as possible together!

Frequently Asked Questions (FAQs)

Here are some common questions about obtaining life insurance quotes online:

- Q: What are the main benefits of getting life insurance quotes online?

- A: Online quotes offer unmatched convenience and speed, allowing you to compare multiple options from home. They also help protect your personal information through secure platforms and provide access to a variety of insurers.

- Q: What types of life insurance policies can I compare online?

- A: You can typically compare term life, whole life, and universal life insurance policies. Each type offers different features, such as temporary vs. permanent coverage, and cash value components.

- Q: Is "no-exam" life insurance a good option?

- A: No-exam life insurance is convenient for those who wish to avoid medical exams or have health concerns. However, it's crucial to review terms carefully as coverage limits might be lower than traditional policies.

- Q: What factors should I consider when analyzing coverage options?

- A: Key factors include the death benefit amount, policy duration and renewal options, and any available riders or additional coverage. Thorough analysis ensures the policy aligns with your financial goals.

- Q: How can I prepare to get the most accurate online quotes?

- A: Gather all necessary personal and financial information beforehand. Choose a reliable online quote tool, input your information accurately, and compare the received quotes thoroughly to make an informed decision.

Recap of Key Points

Here is a quick recap of the important points discussed in the article:

- Instant online life insurance quotes offer unmatched convenience and speed, allowing you to access multiple options from home.

- Protect your personal information with secure online platforms that require minimal details to obtain quotes.

- Understand the differences between term, whole, and universal life insurance to choose the best option for your needs.

- Analyze key coverage options such as policy limits, premium rates, and additional features when comparing quotes.

- Be prepared with your personal and financial information to streamline the quoting process and receive tailored options.

- Thoroughly compare quotes to ensure you choose the best policy for your family's financial goals and security.